Whoa! Right off the bat: trading on decentralized exchanges feels messy. Really. The UX is slick, but the signals? They can be noisy as hell. My gut used to say, “just follow volume,” and for a while that worked. Then a rug pulled the floor out and I learned that volume alone lies. Hmm… somethin’ about that felt off.

Okay, so check this out—DeFi traders care about three things in a pair: liquidity depth, price impact, and who’s actually trading. Short-term traders want low slippage. Long-term holders want resilient liquidity. On one hand, high volume looks sexy; though actually, when volume spikes alongside shallow liquidity you get chop—and often front-running. Initially I thought sudden volume meant genuine interest, but then I realized bot farms and liquidity miners can fake the party. I’ll be honest, that part bugs me.

Here’s the practical: start with the obvious metrics. Look at pool size denominated in the native chain token and stablecoin equivalents. Watch the 24h and 7d volume trend, not just the single-day spike. Pay attention to tick sizes—tiny tick size equals high volatility. It sounds boring, but those bits matter. Seriously?

Price impact charts tell a story most traders ignore. If a $10k buy moves price 20%, that token doesn’t absorb market flow. If you need to exit, you’ll pay. So test order simulation before committing. Many DEX analytics tools give instant estimates—use them. Something felt wrong for me back when I skipped that step and lost more than I can comfortably admit.

Where on-chain signals beat off-chain chatter

My instinct tends to trust on-chain data over social hype. Socials scream, on-chain whispers. On-chain data shows actual capital—wallet flows, liquidity additions/withdrawals, and contract interactions. Watch for concentrated liquidity: a few addresses controlling most of the LP is risky. If one address pulls liquidity, price often collapses. Initially I thought decentralization was enough to keep things stable, but then I saw a single whale remove 90% of a pool and—yikes—market panic followed. Actually, wait—let me rephrase that: decentralization in theory doesn’t equate to dispersed LP holders in practice.

Transaction graphs and owner flags matter. Look for pattern traders: repeated buys at the same block times, or similar sizes clustered—those are bots. Real traders have variance. On the flip side, steady, diverse buys across wallets often indicate organic demand. There are exceptions, sure—market makers can mimic organic flow—but patterns help skew probabilities in your favor.

Okay, here’s a small method I use: the three-scan approach. Scan one: liquidity depth and composition. Scan two: trade history and holder concentration. Scan three: protocol-level risk (timelocks, audited code, admin keys). It’s low-effort and high-impact. Try it once and you’ll see how many “hot” pairs evaporate under scrutiny. (oh, and by the way… keep a checklist.)

Why you should care about impermanent loss and fee regimes. Fees can make shallow pools profitable for LPs despite volatility, which is both good and bad for traders. Protocols with dynamic fees can stabilize markets, though complex fee mechanisms sometimes mask wash trading. My personal bias: I prefer pools with predictable fee structures even if I give up a little yield. I’m not 100% sure that’s always optimal, but it keeps my nights calmer.

Tools and heuristics — what I actually use

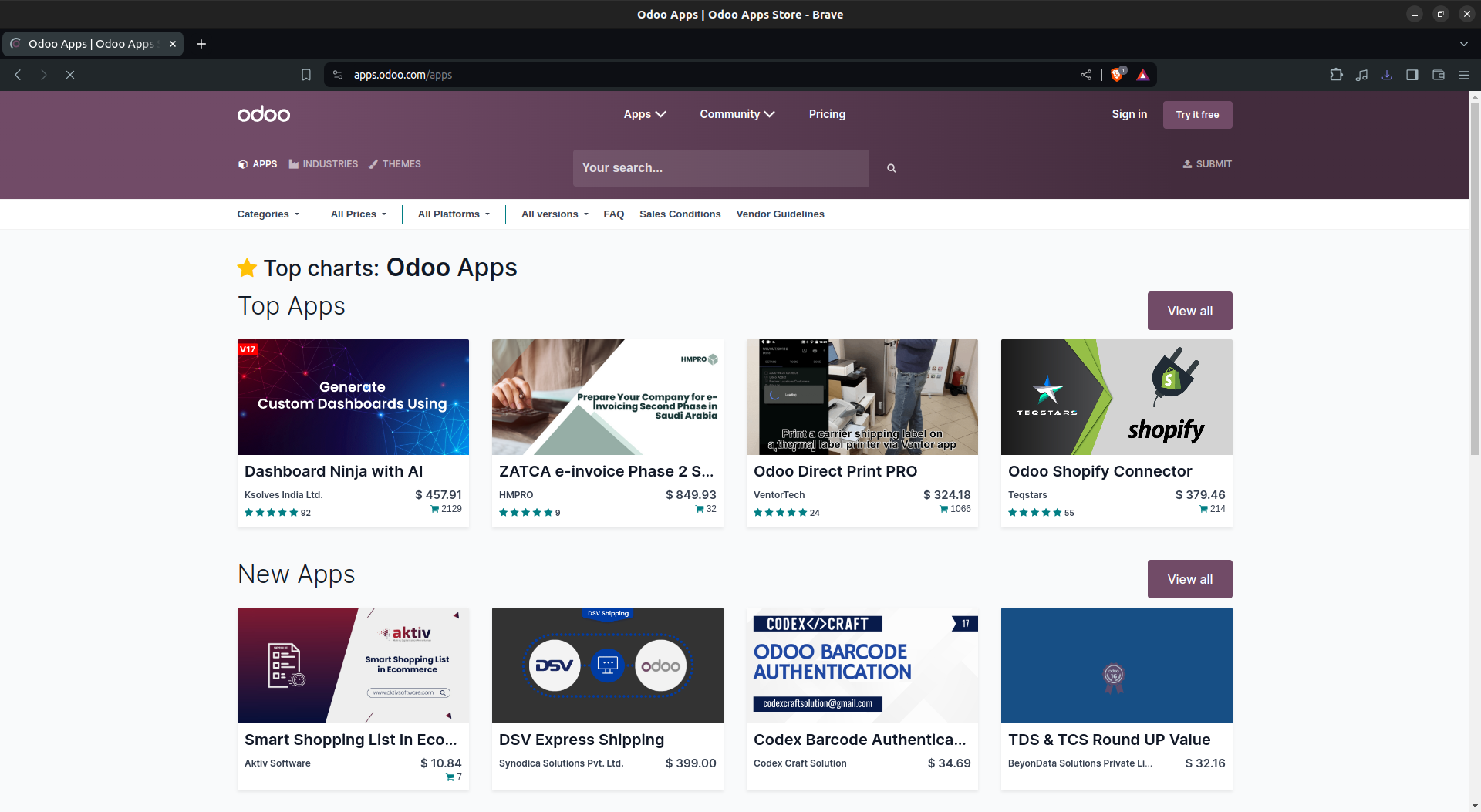

Look, you can drown in analytics dashboards. I use a lightweight toolkit: a quick pool snapshot, a trade-history heatmap, and a wallet-concentration check. If you’re hungry for deeper real-time scanning, there’s a neat resource you can find here that I often point folks to. It’s not perfect, but it’s fast. Wow!

Experiment with order size before you trade. Send a small test swap to measure slippage and gas quirks—on Ethereum L2s this is different than on BSC or Arbitrum. Network choice changes behavior: gasless swaps can hide sandwich attacks, and faster chains mean bots act quicker. My instinct told me to trade where fees were lowest; later I realized speed and MEV exposure matter more sometimes.

Layer in fundamental checks. Does the token have a clear use case? Are LPs incentivized by rewards that will end soon? Perfomance tied to fleeting incentives often collapses post-reward. On one project, the TVL tripled during launch incentives and then halved when rewards stopped. Learn to separate protocol health from temporary yield. On the other hand, some protocols sustain growth—so watch governance and development activity.

Risk-signal checklist (quick):

– Liquidity concentration > 40% in top 3 wallets. Bad.

– Rapid liquidity spikes coupled with washed volume. Red flag.

– Admin keys not timelocked. Margin for disaster.

– Audit absent or cursory. Proceed cautiously.

FAQ

How big of a trade can a pool absorb?

Simulate it first, or run a dry swap. Use price impact charts and depth metrics. If a 1 ETH trade moves price 5% in a token, a 10 ETH trade will do worse than linear scaling—expect slippage to compound. My rule: never execute a trade larger than 1–2% of pool depth unless you want to pay for it.

Can analytics predict rug pulls?

No tool guarantees prevention, but analytics reduce odds. Look for advisory signs: sudden LP withdrawals, dev wallets selling, or tokens minted without distribution transparency. On one hand such signals are suspicious; on the other hand, legitimate rebalances happen. It’s a judgment call—so use on-chain clues plus skepticism.

Which DEX metrics should I monitor in real-time?

Top three: real liquidity (not LP tokens), trade frequency, and new wallet entrants versus repeat traders. If growth is broad-based across many wallets, it’s healthier than growth driven by a few repeat high-volume traders.

Alright—wrapping up without a neat bow. My feelings on DEX analytics have evolved from optimism to cautious curiosity. I still get excited; I also sleep with less anxiety now because I do a quick triage before trades. On balance, tools and on-chain scrutiny tilt the odds in your favor, though they don’t erase risk. I’m biased toward simplicity; keep your watchlist tight. That helps—trust me. Really.